Tag: financial

-

Small Business Financing Infographic: Know Your Loan Options

When it comes to small business lending options there unfortunately is no one-size-fits-all package. Businesses must consider the pros and cons of short-term lending, investment lending, loan sizes, varying interest rates and a variety of other factors. For a first-time loan seeker, sifting through these options can become overwhelming without a little help. Ultimately, the…

-

The Costs Associated with a DUI

The costs associated with DUI or DWI. You know that a DUI can be expensive but do you really know how expensive one can be?

-

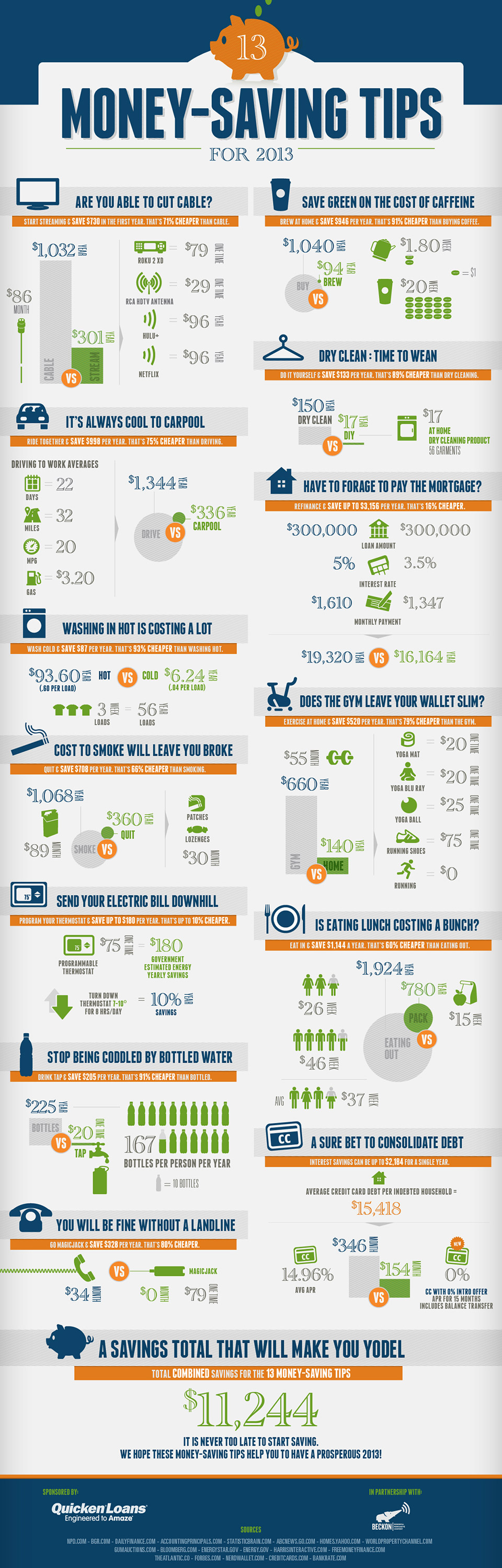

13 Money-Saving Tips for 2013

How would you like to start out the New Year saving money? This infographic will show you 13 different money saving tips that will help you save a combined total of $11,244.00! These tips are simple adjustments to your daily life that will help you take control of your debt and fatten up your bank…

-

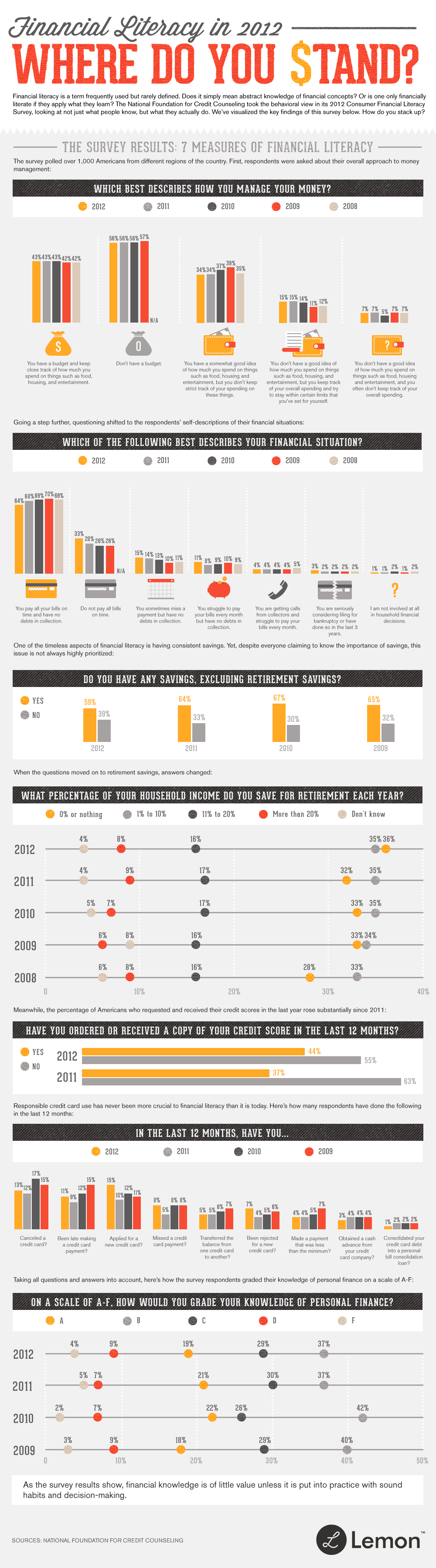

Financial Literacy in 2012: Where Do You Stand?

Financial literacy is a term frequently used but rarely defined. Does it simply mean abstract knowledge of financial concepts? Or is one only financially literate if they apply what they learn? The national Foundation for Credit Counseling took the behavioral view in its 2012 Consumer Financial Literacy Survey, looking at not just what people know,…